The corporate structure of any business is like a well-oiled machine, where each part plays a vital role. Two such key roles are the Chief Executive Officer (CEO) and the Chief Financial Officer (CFO). The CEO and CFO have distinct responsibilities and roles in the company, but they also share some similarities.

Let’s delve deeper into understanding these two positions.

Basic Corporate Structure

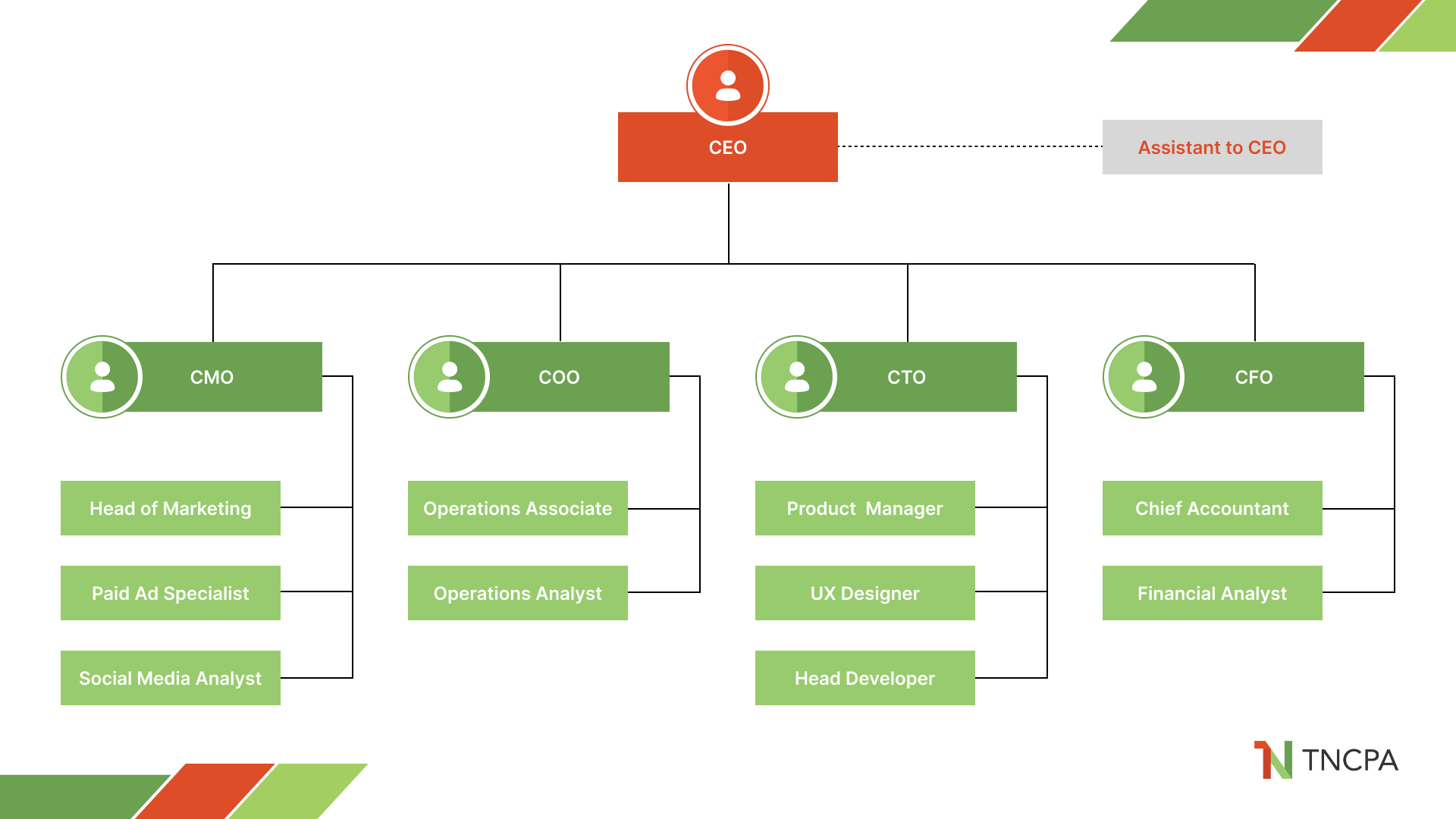

In a basic corporate structure, there are several key positions that contribute to its smooth functioning. The Board of Directors sits at the top, followed by the CEO. The CEO is generally the highest-ranking executive in a company. Other key positions include the CFO, Chief Operations Officer (COO), and various department heads.

What Is A CEO?

The CEO, also known as the Chief Executive Officer, holds the highest position within the company. They play a critical role in making significant corporate decisions and oversee the overall operations and allocation of resources.

In addition to their responsibility as the main point of communication between the board of directors and corporate operations, the CEO provides strategic direction and leadership to drive the company towards its goals and objectives.

Their extensive knowledge and expertise in various aspects of the business make them indispensable in ensuring the company’s success in a constantly evolving market.

What Is A CFO?

The CFO, also known as the Chief Financial Officer, plays a crucial role in the company by overseeing and managing all financial aspects. With a focus on financial planning, risk management, record-keeping, and financial reporting, the CFO ensures that the CEO and the board have accurate and timely information regarding the company’s fiscal well-being.

By meticulously analyzing financial data, monitoring key performance indicators, and implementing effective financial strategies, the CFO fosters stability, growth, and long-term success for the organization.

Key Similarities And Differences

While both the CEO and CFO are high-ranking executives within a company, their roles, responsibilities, and skills required are quite different.

Here are some key similarities and differences between the two roles:

Ranking In The Organizational Structure

Both the CEO and CFO are part of the executive team, but the CEO usually ranks higher. The CFO typically reports to the CEO, who in turn reports to the board of directors.

Positions Under Them

Under the CEO, there are various department heads, including the CFO, COO, and others depending on the company’s structure. Under the CFO, there are positions like Controller, Treasurer, and Financial Planning & Analysis Manager.

Skill Sets Required

While both roles require leadership skills, the CEO needs to have a broad understanding of all aspects of the business, whereas the CFO needs to be highly skilled in financial analysis and planning.

Experience Needed

Both positions usually require significant experience in business or management. However, a CEO may come from any background, while a CFO typically has a background in finance or accounting.

Scope Of Responsibilities

The CEO is responsible for the overall success of the business and is the face of the company. They make strategic decisions and set the company’s course. On the other hand, the CFO is responsible for managing the company’s finances, including financial planning, management of financial risks, record-keeping, and financial reporting.

Do CFOs Make Good CEOs?

One of the common questions in the corporate world is whether a CFO can make a good CEO. The answer varies; some CFOs transition smoothly into the CEO role, while others may struggle. A CFO’s deep understanding of financial matters, risk mitigation, and strategic planning can be beneficial in the CEO role. However, they also need to develop a broader perspective and skills beyond finance, such as leadership, marketing, public relations, and more.

The Importance Of A Good CEO-CFO Relationship

The relationship between a CEO and CFO is undoubtedly crucial for the success and prosperity of an organization. As the top executives, they possess distinct yet interconnected roles that contribute to the overall functioning of the company.

Here are some of the benefits of a good CEO-CFO relationship:

Alignment Of Strategic Vision

The CEO and CFO must align their strategic visions for the company. The CEO’s broad vision should be complemented by the CFO’s financial perspective to ensure balanced and sustainable growth.

Planning And Decision Making In Finance

Financial planning and decision-making processes greatly benefit from the combined insights of the CEO and CFO. While the CFO brings in-depth financial knowledge, the CEO provides a wider business perspective.

Integrity And Trust In Communication

Trust and open communication form the backbone of a strong CEO-CFO relationship. Both parties should feel comfortable discussing and debating various issues, including finances, strategies, risks, and opportunities.

Management Of Investors And Stakeholders

The CEO and CFO often interact with investors and other stakeholders. Their united front and clear communication about the company’s performance and strategy can enhance stakeholder confidence.

How CEOs And CFOs Contribute To A Business’ Success

Both CEOs and CFOs are integral to the success of a business. The CEO sets the strategic direction and makes key business decisions, while the CFO oversees the financial well-being of the company. Together, they effectively manage risks and drive growth through strategic decision-making.

When Do You Need A CEO Or CFO?

While every company requires leaders, the necessity for a CEO or CFO can vary depending on factors such as company size, operational complexity, and growth stage. Initially, in the early stages of small startups, there may not be a designated CFO.

However, as the company expands and faces increased financial challenges and opportunities, the importance of having a dedicated financial expert becomes increasingly evident. A CFO brings valuable insights and expertise to guide strategic financial decisions, manage risks, and ensure long-term financial stability, playing a pivotal role in the success and sustainable growth of the organization.

Benefits Of Outsourcing Your CFO

For some companies, particularly small businesses or startups, outsourcing the CFO role can be beneficial. It provides them access to expert financial advice without the cost of a full-time executive.

Outsourcing also allows businesses to take advantage of the expertise and experience of an external CFO who can provide a valuable outside perspective on their financial strategies. Additionally, it provides flexibility in terms of the scope and duration of the engagement which can be tailored to fit the organization’s changing needs.

Build A Winning Team To Ensure A Favorable Bottom Line

In summary, the foundation of a thriving business lies in the synergy of capable leaders. The CEO and CFO play indispensable roles within this team, each possessing unique strengths that complement one another. Fostering collaboration, strategic alignment, and open communication becomes paramount in propelling the company towards sustainable profitability and growth.

Maximize profitability and make informed decisions with the support of our professionals. Are you ready to take your business to new heights? Schedule an appointment today.